Is carbon revenue too flighty for Washington to depend on it to solve some of its budget woes—including the State Supreme Court’s McCleary mandate to fully fund education? If a carbon price is successful at cutting pollution, won’t the revenue stream dry up as the pollution dwindles? The answer is no. Price and pollution are related; the price must progressively increase to continue curtailing pollution. If Washington keeps ratcheting down the pollution, it will receive a carbon revenue stream that will steadily rise for the next two decades and then flatten out in the 2040s.

Because it is difficult to make predictions, especially about the future, I offer three plausible price scenarios based on what we know. We know that pollution responds to price. We know that complementary policies, such as investments in energy efficiency, can work with a price to cut the cost of paring pollution. Each of the scenarios below assumes the Evergreen State hits its existing pollution abatement goals: getting back to 1990 levels of pollution by 2020, then cutting to 25 percent below 1990 levels by 2035, then slashing to 50 percent below 1990 levels by 2050.

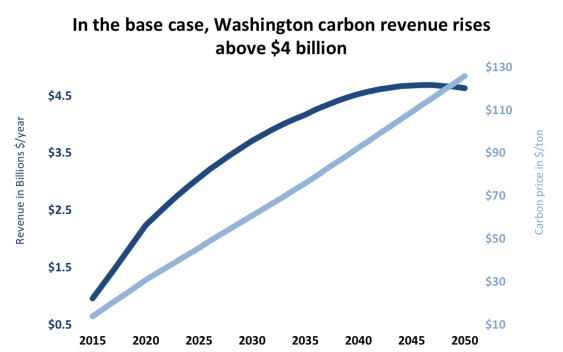

Base Case: What the US Price Models Predict

The top US carbon price models suggest that, to cut pollution 50 percent below 2005 levels by 2050, a carbon price will need to rise to around $30/ton by 2020, $75/ton by 2035, and $125/ton by 2050. This is roughly equivalent to Washington’s 2050 goal of 50 percent below 1990 levels by 2050. The main factors that could change the prices are: population growth, complementary policies, and technological advances. Washington is not meaningfully different from the United States on these factors: expected population growth is similar to the national average; Washington would adopt some policies that help capture cheap pollution-trimming opportunities—like energy efficiency—that are otherwise blocked by market barriers; and any technological advances in coming years would be shared across the country. For these reasons, this US price scenario is a reasonable estimate.

Washington would collect more than $2 billion per year in carbon revenue by 2020, steadily rising until revenue flattens out at around $4.2 billion per year in the 2040s. That’s around 12 percent of Washington’s tax base.

Original Sightline Institute graphic, available under our free use policy.

High Price: No Complementary Policies

Instead of using a multi-pronged policy approach similar to California, Washington could rely on price alone to lessen pollution. While it is unlikely that Washington would eschew all other policy options and pursue price alone, it is worth seeing what this strategy would look like. It would require a much higher price: a recent analysis concluded that price alone would need to reach $70/ton in 2020 and $240/ton by 2035 to get Washington to its goals. A higher price means more revenue: more than $5 billion in 2020, rising to more than $14 billion a year in the 2040s. This scenario is the only one in which revenue tapers slightly in the final years—it drops from $14.3 billion in 2046 to $14.0 billion in 2050. Washington could choose to continue de-carbonizing its economy even more after 2050 by pushing the price even higher. Doing so might result in a flat revenue stream. In the near term, in this scenario, carbon prices would generate around 30 percent of Washington’s tax base.

Original Sightline Institute graphic, available under our free use policy.

Low Price: Everything’s Peachy

The US price models suggests that if cutting pollution turns out to be cheap due to factors such as successful complementary policies, pollution responding more readily to price increases, technological breakthroughs, or low population growth, then the price could be only $20/ton in 2020, $45/ton in 2035, and $75/ton in 2050. In that case, the revenue stream would be more flat and stable: Washington would collect $1.5 billion in 2020 and around $2.8 billion annually in the 2040s; around 9 percent of the tax base. That’s much less than the other scenarios, but it’s still a king’s ransom.

Original Sightline Institute graphic, available under our free use policy.

Count on It

Carbon revenue won’t dry up. It could be only 9 percent of Washington’s tax base or it could be 30 percent, but it will be a steadily rising revenue stream for many decades. It wouldn’t be wise to bank on $14 billion per year, but Washington could conservatively count on $1-2 billion per year for many years.

Technical Notes:

- Washington’s 1990 GHG emissions were 88.4 MMT. This means the state’s goals are to emit 88.4 MMT in 2020, 66.3 MMT in 2035, and 44.2 MMT in 2050. A carbon price would likely cover emissions from electricity, transportation fuels, and residential, commercial, and industrial sectors. The 1990 emissions for those sectors were 73.6 MMT. This means that the 2035 and 2050 priced emissions would be 55.2 MMT and 36.8 MMT.

- Washington’s 2005 emissions were 94.8 MMT. Reducing by 50 percent would mean 47.4 MMT, which is close to the 44.2 target for 2050. So the modeling for reducing 50 percent below 2005 levels by 2050 is roughly equivalent to Washington’s goal.

- The Energy Modeling Forum (EMF) has been modeling carbon prices for decades. The forum is the most robust conglomeration of carbon price forecasts that I am aware of. It utilizes many different models with a range of assumptions. The 2012 EMF modeling shows a range of prices for achieving GHG reductions of 50 percent below 2005 levels by 2050: from $40/ton to $500/ton, with most clustered around $100-$150/ton. The 2014 modeling similarly shows the nine models and eight scenarios clustering around $150/ton. I used a “most likely” price scenario that falls in the middle of the range of EMF forecasts.

- Synapse Energy did an analysis in 2013 to project likely US CO2 prices. It references the EMF modeling as well as the carbon price forecasts that utilities use in their Integrated Resource Plans. It concluded that the likely 2040 price for a medium reduction target would be $60/ton, or $90 for a more aggressive target. This is slightly lower than the EMF models, presumably because Synapse’s prediction was influenced by the utility forecasts, which are lower than the EMF forecasts. I believe the EMF models are more accurate than the utility forecasts because utility forecasts take into account political and business strategies that are not reflected in the EMF modeling. I used a “most likely” price scenario that is very similar to but slightly higher than Synapse’s—my scenario assumes $92/ton in 2040.

- In 2011, University of Washington PhD candidate Keibun Mori analyzed the impact of a carbon price on GHG emissions in Washington State, including a sector-by-sector price elasticity analysis. He concluded that a tax of $70/ton would be required to reduce Washington emissions to 1990 levels, and $240/ton to meet Washington’s goal of reducing 25 percent below 1990 levels by 2035.

- Cutting pollution often turns out to be cheaper than expected. Many economists have assumed that price elasticity for energy—particularly transportation fuels—is very low, but recent fluctuations in gas prices and subsequent changes in driving have undermined this assumption. I wanted to make sure that the 2011 analysis used the most recent information on fuel price elasticity. In 2012, the Victoria Transport Policy Institute conducted a review of the literature on gasoline price elasticity of demand and found that the long-run fuel price elasticity ranges from -0.4 to -0.8. This indicates that increasing the price of gas by 10% will lead to a 4 to 8 percent reduction in driving. This range mirrors the gasoline elasticities that Mori used in his analysis.

- Portland State University studied the impact of a carbon price on Oregon GHG emissions. Its 2013 report concluded that a carbon price of $100/ton would be needed to reduce Oregon’s emissions to 1990 levels by 2030. This is slightly higher that the Washington estimate, but within range. PSU is currently conducting a deeper analysis of a carbon tax, due to be released in November 2014.

- Canada’s National Round Table on the Environment and Economy concluded in 2009 that the country would need a price of $100/ton to achieve the goal of cutting 20 percent below 2006 levels, and $300/ton to achieve the national reduction goal of 65 percent below 2006 levels by 2050. This is close to the range of the EMF models.

- Point Carbon, a market group rather than a research group, has issued several forecasts of California carbon prices. Considering that its 2011 prediction was that prices would dramatically rise to $75/ton by 2020, but its 2013 prediction was 80 percent lower—only $15/ton by 2020—its modeling seems unreliable. I did not use it for this article.

- Note that California’s 2050 target is more stringent than Washington’s—80 percent below 1990 levels, compared to just 50 percent below 1990 levels. If Washington joins California and California extends its cap to 2050, the two states will need to negotiate a mutually acceptable 2050 reduction goal. If Washington chooses the more aggressive goal, emissions would decrease and prices would increase.