The Morrow Pacific project, a coal export venture being pursued by Australian firm Ambre Energy, aims to ship coal by rail to Oregon’s Port of Morrow on the Columbia River, barge it downstream to a second port, and load it onto cargo ships bound for Asia. Recent financial disclosures suggest that the project would face unusually high costs in three separate areas:

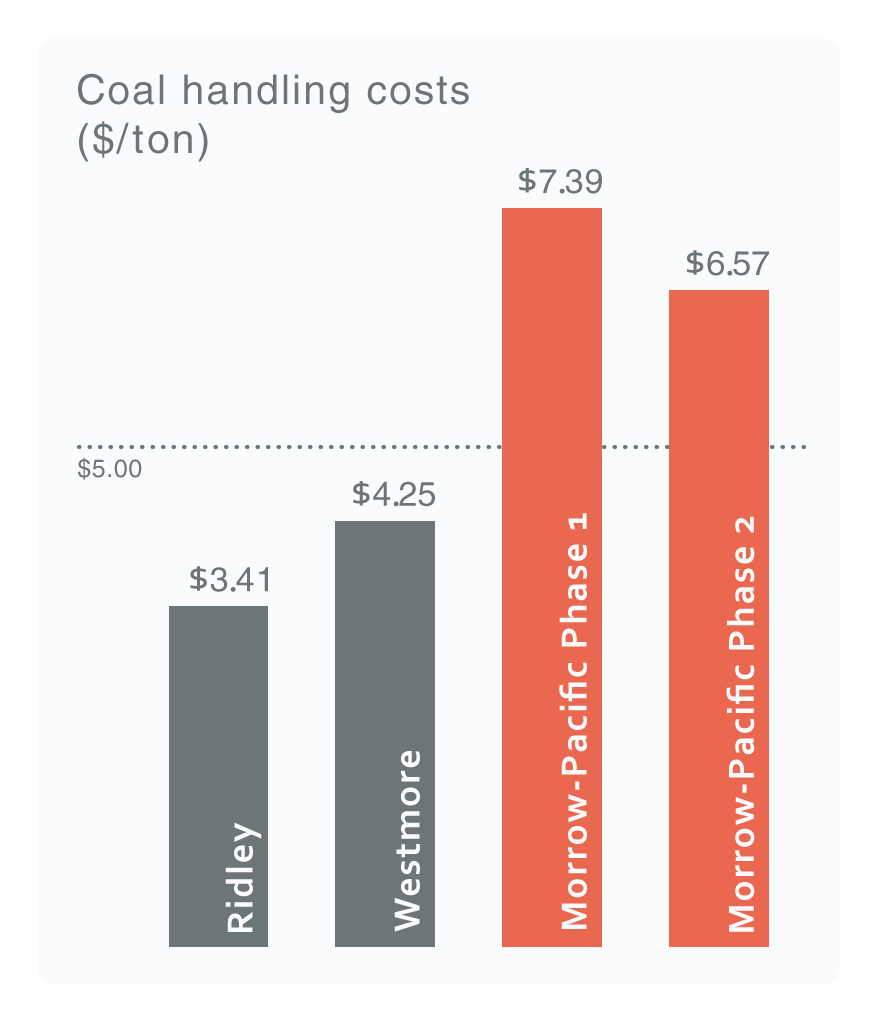

- High handling costs. Unlike conventional export projects that would handle coal at a single location, the Morrow Pacific project would transfer coal twice—first from rail cars to barges, and later from barges to ocean-going vessels. The extra step boosts coal handling costs.

- High transportation costs. Based on Ambre’s projections, barging the coal 150 miles downstream would likely cost more than shipping coal directly by rail.

- High capital costs. Morrow Pacific would require 36 custom-designed barges, as well as costly coal loading equipment for two separate sites, giving the project higher capital costs per ton than its competitors.

If built, Morrow Pacific would have the highest costs of any terminal in the Pacific Northwest, facing cost disadvantages of roughly $5 to $11 per ton of coal compared with its likely rivals. The project’s high cost structure would likely curtail profits, erode revenues, and even turn Morrow Pacific into a terminal of last resort, used only in the event of exceptionally high overseas demand. Careful investors would be wise to compare Morrow Pacific’s costs with the costs faced by rival terminals before committing funds to the project.

Morrow-Pacific-June-2013_Sightline InstituteCare to comment? The report is also featured on our blog.