If you don’t enjoy filing your taxes each year, please imagine trying to get around to it while dealing with an eviction.

Or trying to document your income from five different gigs, two of which were paid in cash and three of which ended months ago.

Or trying to do it from jail.

And let’s add that in each of these scenarios, you’re a single parent.

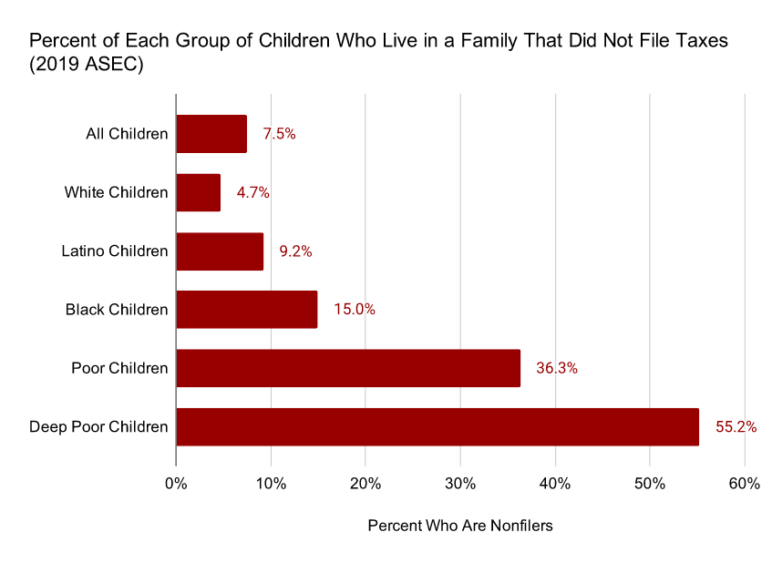

Scenarios like those are part of the reason the demographics of children in US families who didn’t file taxes last year look like this:

Image: People’s Policy Project. Source: US Census Annual Social and Economic Supplement.

Half of US kids in deep poverty live in households that don’t file taxes.

This is why it is not a good idea for cash benefit programs intended to help poor people to send cash only to people who get around to filing their taxes. It’s not a poor kid’s fault that their parents tend to have a lot of other things to deal with.

Universal programs make it much easier to get cash to poor people

For the first time ever this year, the United States will join numerous other wealthy countries in giving recurring cash payments to families with kids. Including—and for the United States, this is the big breakthrough—to the kids who need money most.

As we’ve been arguing since before the American Rescue Plan was introduced, these payments are like a universal housing voucher program for kids, but better. Making them permanent would be an epochal victory in the fight to house vulnerable Americans.

To the extent that they actually reach the most vulnerable Americans, that is. Writing Monday for the People’s Policy Project think tank he runs, Matt Bruenig noted that many poor kids will never see the program’s benefit:

The IRS announced earlier today that it would begin making advanced refundable monthly child tax credit (CTC) payments on July 15 of this year. In the IRS release, the agency says that 88 percent of children will receive the payments. According to the last CPS ASEC, around 2 percent of children are too rich to be eligible for the CTC. Thus this 88 percent number indicates that about 10 percent of eligible children will not receive CTC payments. …

The IRS has no way of reaching kids in non-filing tax units and no one has produced a plausible story of how they will do so. Filing taxes is complicated and the poorest of the poor cannot afford to pay a third-party preparer to do it for them. Even people who have the ability to file taxes may not be aware of the program or may be confused by the idea of “filing taxes” when they have no income to report.

There is a solution to this problem. The United States could send payments each month to the birth mother of every child, with adjustments for any custody changes. Because there would be no way to verify every family’s current income, this would require also sending payments to the two percent of American children whose families are too rich to qualify for the American Rescue Plan’s child payment. Even so, if Congress thinks it’s important to prevent those families from getting a net benefit, it could simply pay for some of the program by raising taxes on people in that income bracket.

Under the logic of the American Rescue Plan, it’s more important to not send money to the richest children (even if the country then taxes it away again) than it is to send money to a much larger number of poor children.

Lawmakers are not accustomed to thinking about universal programs

In February, the Washington Post quoted Howard Gleckman, senior fellow at the Tax Policy Center, giving a very clear explanation of why the country is choosing to withhold cash from kids whose parents don’t file taxes.

A more universal system, he said, is “not going to happen. … Congress is not going to do that.”

That’s how a lot of policymaking works, of course: momentum. Change won’t happen because it won’t happen.

Fortunately, citizens and organizations are also free to attempt to change the momentum. That’s what a number of institutions here in Cascadia, mobilized by Sightline, are doing. As Congressional debate continues over future reconciliation packages that could include a potential renewal of the one-year child payment, 14 Pacific Northwest institutions have signed a letter to our representatives in Congress, urging these payments to be made both permanent and universal.

Washington-based signers include Fuse Washington, Economic Opportunity Institute, Chief Seattle Club, the Washington Low-Income Housing Alliance, Children’s Alliance, MomsRising, the Washington State Budget and Policy Center, and Sightline itself. Oregon-based signers include the Community Alliance of Tenants, Business for a Better Portland, The Street Trust, the Oregon Education Association, Our Children Oregon and Oregon Center for Public Policy.

There’s reason to think such efforts around the country are being heard, thanks to leadership from Senate Finance Committee Chair Ron Wyden (D-OR), Rep. Suzan DelBene (D-WA) and others. Last month, the Biden administration revised its legislative proposals for child tax credit reform to keep sending cash to poor kids permanently rather than its previous proposal to phase the credit out completely in 2025. That’s still not a universal payment, but it is a step in the direction of getting cash to more kids who need it.

I don’t know about you, but the one big thing I actually enjoy about Tax Day every year is that I know a lot of the money is going to help people, just as various government programs have helped me over the years. I doubt I’m the only American who would like to know that more of my tax bill is going to people who need it most.

Christina Irwin

Half of US kids in deep poverty live in households that don’t file taxes.–These individuals need cash for their children’s survival even more than those who do file.

Edwin J. Pole, II

Just how is the federal government to identify all the people receiving a check, weed out the fraudsters, take into account the fathers who are sole source of income for a family, identify those parents who have lost custody, …? It is really easy to fill out a 1040 just as it is easy to get an official ID. If one cannot do that, maybe one shouldn’t be responsible for the welfare of minors.

Michael Andersen

Well, the number of people who are able to fraudulantly give birth to or immigrate with a child is almost certainly low, so a universal program would presumably have pretty low fraud rates – like you say, basically just those who lose custody, which seems manageable. An IRS program, probably harder to enforce.

That said, even with an IRS program, pick your poison: do you prefer to have some people getting money they aren’t entitled to, or to have other people being financially destitute for no reason other than the accident of their birth?