Ambre Energy: Caveat Investor

Editor’s note: On Wednesday, February 13, 2013, Sightline’s Clark Williams-Derry and Alan Durning, with Tom Sanzillo, Finance Director of the Institute for Energy Economics and Financial Analysis, hosted a live, phone-based news conference about the report’s findings. Listen to a streaming audio replay, and read the press release here. Care to comment? The report is also featured on our blog.

The decline of US coal demand has sparked renewed interest in exporting American coal to Asia. One of the highest-profile players in the coal export arena is an Australian firm called Ambre Energy, which is planning two controversial export terminal projects on the Columbia River in Washington and Oregon.

But the coal export debate has largely overlooked a curious fact: Ambre Energy barely qualifies as a coal company. The company’s annual reports reveal that the Australian-based venture has never made a profit, and has virtually no successful track record in coal mining or coal exports, either in the US or abroad. Worse, an in-depth look at the company’s financial statements, as well as public records of other companies that have done business with Ambre, reveals a firm with deeply troubled finances, including:

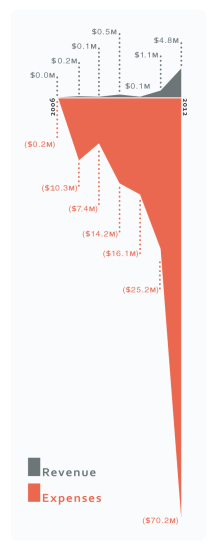

- Minuscule revenues: the firm has collected only $6.6 million in worldwide revenues over the past 7 years.

- Massive losses: Ambre has accumulated $124 million in losses on its balance sheets.

- Failed Australian venture: The firm recently admitted that it lost $10.9 million on a failed coal project in Australia.

- Huge liabilities: The company is on the hook for hundreds of millions of dollars for mine reclamation and site cleanup, retiree medical and pension benefits, and costs arising from a recent legal settlement.

- Troubled assets: Ambre may see little value from some of its assets, including a $65 million bond cash holding dedicated for mine reclamation, and $19 million in shale oil development costs.

- High borrowing costs: The company has taken out multi-million dollar loans with annual interest rates of at least 10 percent, and a “balloon” loan charging 12 percent interest.

- Massive capital needs: Ambre needs to raise about $1 billion to bring its coal export plans to fruition.

Potential investors in Ambre, as well as the communities and businesses hoping to benefit from the firm’s business, would be wise to consider Ambre’s finances and troubled history before committing money or other resources to the company’s export ventures.

Ambre Energy: Caveat InvestorCare to comment? The report is also featured on our blog.