PSE’s growth natural gas growth projections miss the mark

Puget Sound Energy (PSE) consistently overestimates gas peak demand and customer growth

Puget Sound Energy (PSE) based in Bellevue, WA, provides both gas and electric service across western Washington. Its gas service territory serves 850,000 customers including those in the urban cities of Seattle, Bellevue, Everett, Tacoma and Olympia. With aggressive energy conservation, new state emissions policies, and the wave of building electrification on the horizon, growth on the gas side of its business is looking increasingly dire. Indeed, a review of PSE’s past forecasts shows that this reality for the utility has been crystalizing for more than a decade.

Over the past decade, PSE has consistently reduced estimates for customer growth and peak day demand on its gas system in its biennial integrated resource plans (IRPs), two main determinants for driving expansion of gas infrastructure. Simultaneously, PSE has routinely underestimated the amount of energy that can be saved through its state-mandated energy conservation programs–programs that mitigate the need for infrastructure investment. And in the larger policy landscape, the recently passed Climate Commitment Act (CCA), the state energy code, and local government energy codes are all poised to further reduce the company’s natural gas use.

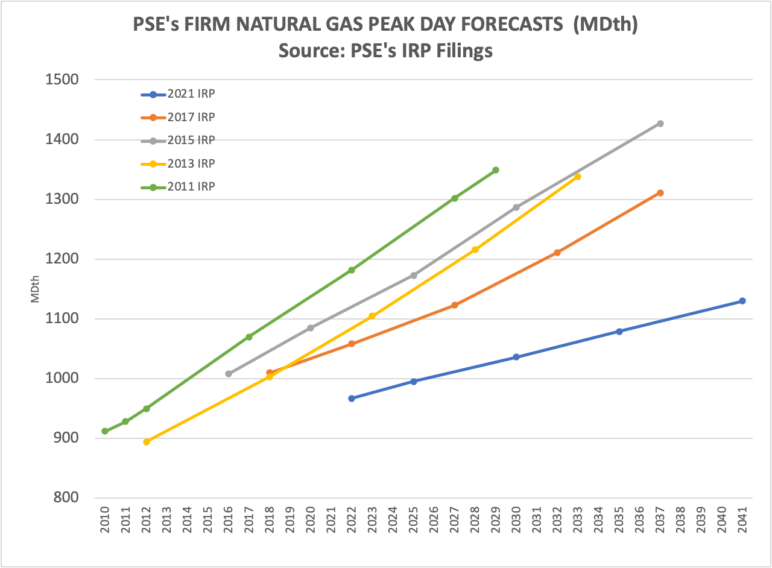

In 2011, PSE estimated that its peak day demand, the maximum gas use in a single day, would grow by 2.1% annually. Yet in its latest IRP, released in April 2021, PSE forecasts the base peak day demand to grow only 0.8% annually through 2041. Moreover, when demand side resources like energy efficiency are applied to the peak day forecasts, growth slips to 0.3% annually.

A decade ago, PSE was telling regulators its peak day demand would reach 1349 MDth by 2029 but that milestone isn’t even on its 20 year horizon now; in its 2021 IRP, PSE is projecting its peak day in 2041 to top out at 1130 MDth, well below the estimates from earlier IRPs. The graphic below captures the trend: PSE’s forecasts for growth keep declining and are likely to drop further. New laws and regulations affecting gas use have also passed subsequent to the filing date of the 2021 IRP. Anticipated peak demand growth simply isn’t materializing according to the timelines that PSE states. In fact, if the trends hold, it will likely never be realized.

Another metric to consider is forecasted customer growth, a leading indicator of revenue growth because additional customers often translate into new infrastructure investments. Here too, PSE’s outlook reveals slow growth and unrealized expectations. Over the past decade of IRPs, PSE’s 20-year projections for annual customer growth have dropped from 2.1% in 2011 to 1.0% in 2021. During this same time period, actual growth from 2011-2020 has clocked in at 1.2% annually, nearly half of the 2011 projection of 2.1%. This slowed customer growth fails to incorporate the impacts that Washington’s forthcoming cap and invest program and the state’s leadership on energy codes will have on customer retention and new construction that includes natural gas.

Another metric to consider is forecasted customer growth, a leading indicator of revenue growth because additional customers often translate into new infrastructure investments. Here too, PSE’s outlook reveals slow growth and unrealized expectations. Over the past decade of IRPs, PSE’s 20-year projections for annual customer growth have dropped from 2.1% in 2011 to 1.0% in 2021. During this same time period, actual growth from 2011-2020 has clocked in at 1.2% annually, nearly half of the 2011 projection of 2.1%. This slowed customer growth fails to incorporate the impacts that Washington’s forthcoming cap and invest program and the state’s leadership on energy codes will have on customer retention and new construction that includes natural gas.

On the flip side, PSE bolsters its growth projections by underestimating the amount of conservation it can acquire from its ratepayers. By state law, gas companies in Washington are required to “identify and acquire all conservation measures that are available and cost-effective”. Year-over-year, PSE’s customers have out-performed PSE’s conservation targets, often by double-digit percentages. Only during the COVID-19 pandemic have conservation targets fallen short, largely due to the need to temporarily halt the efficiency programs and retool to accommodate the emerging pandemic impacts. Yet even with this pandemic-related set back, PSE is planning on massive conservation acquisitions over the next 20 years, estimating that the 2041 gas peak demand will drop an additional 9.8% to 1019 MDth with conservation. Put in perspective, all IRPs previous to the 2021 IRP anticipated reaching that peak demand of 1019 MDth by 2019. This flattening of gas demand erases the need for capacity additions, and will force a rewriting of the utility’s plan for revenue growth through infrastructure investments.

| Program Year* | Target Savings (MDth) | Actual Savings (MDth) | Percent Underestimated |

| 2014 | 388 | 434.6 | 10.7% |

| 2015 | 308.1 | 324.2 | 4.97% |

| 2016 | 396.3 | 448 | 11.54% |

| 2018 | 327 | 377.1 | 13.29% |

| 2019 | 314.7 | 322.8 | 2.51% |

| 2020 | 462.9 | 410.3 | -11.36% |

| 2021 | 339.0 | not yet filed |

*data was not available for 2017

Perhaps the biggest threat to PSE’s gas business is looming on the horizon as cities, counties, the state legislature, and regulatory agencies in Washington continue to pass and implement decarbonization policies. The 2021 Climate Commitment Act (CCA) sets into law an economy-wide cap-and-invest program aimed at meeting Washington’s statutory greenhouse gas reduction goal of reducing emissions 95% from 1990 levels by the year 2050. The 2050 cap for all covered sectors, which includes industry, electricity generation, gas suppliers, and other energy facilities – will be less than 4 million tons of emissions. Residential and commercial gas use in the state currently generates double that – around 8 million tons. To reduce gas emissions cost-effectively, the sector will have no choice but to significantly reduce gas use to remain in compliance with the law.

The CCA is not the only policy that will impact PSE’s gas business. Local jurisdictions around Washington are moving on a number of policies to transition off gas, including carbon-based energy codes and building performance standards. The state energy code already requires high levels of energy efficiency and a 70% reduction in energy use from 2006 levels by the year 2031 in alignment with greenhouse gas reduction goals. The statewide code may be strengthened further as the State Building Code Council considers requiring electric space heating and cooling as well as electric water heating in most new commercial and multifamily buildings. Other policies under consideration by regulators and lawmakers would significantly change the economics of expanding gas: the elimination of line extension subsidies could disincentivize new customers from hooking up to the gas system.

PSE is at a crossroads: growth in its gas business is untenable and in conflict with legal requirements if it continues to rely on fossil-based natural gas.