Series: Coal Exports: Caveat Investor

En route from Seattle to China, the Selendang Ayu breaks up in Alaska in 2004. (Photo from US Coast Guard.)

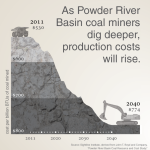

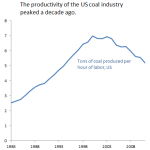

As domestic demand for coal has tumbled, the coal industry has grown increasingly desperate to shore up falling revenues by exporting coal to Asia. And that’s why there have been so many controversial proposals to develop coal export terminals in the Pacific Northwest: the industry thinks that the Northwest offers the cheapest route to move coal from Montana and Wyoming to China, Korea, and Taiwan.

Yet careful Sightline analysis shows that the numbers simply don’t add up to profits for anyone investing in these proposals. Instead, they are highly risky financial ventures with the potential for massive and irreversible losses.