A few years back, when most oil industry analysts thought that oil prices would remain in the $100-per-barrel range for the foreseeable future, domestic oil companies found that they could earn a healthy profit by fracking “tight oil” out of shale rock formations. Drilling activity in North Dakota, home of the oil-rich Bakken Shale, shot through the roof, catapulting the Flickertail State (yes, that’s an actual nickname for North Dakota) into the #2 oil-producing state in the country, second only to Texas.

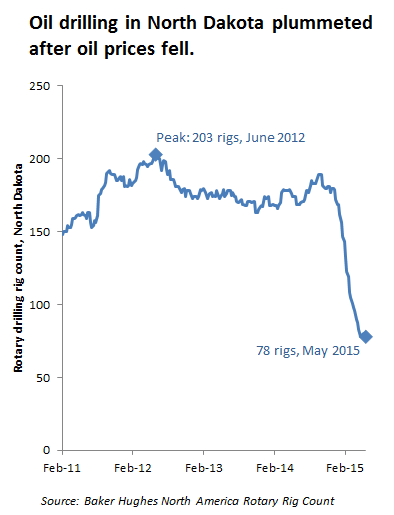

But starting in the summer of 2014, global oil prices began to collapse. Within a few months, US prices had fallen below $50 per barrel, and oil drilling activity in North Dakota collapsed. Take a look at the oil drilling trend for North Dakota, derived from the Baker Hughes North American rotary rig count.

North Dakota oil drilling collapsed after oil prices fell. North America Rotary Rig County data by Baker Hughes

It’s perhaps a little early to see the drilling collapse in the state’s oil production statistics. But some Wall Street analysts have certainly noticed the drilling trend and are starting to speculate that the collapse in shale oil drilling could lead to a new round of oil price volatility.

For the Pacific Northwest—where the oil industry has proposed a host of oil-by-rail projects up and down the coast—the implications of this trend are clear: the oil business is fraught with uncertainty. For years, the oil industry thought that prices would stay high, and that fracking the Bakken would be a stable business. So they planned massive terminal projects to handle all of the new oil they expected to produce.

But if today’s rig count is to be believed, it’s not at all clear that Bakken fracking is economically sustainable. And that raises huge questions about the economic viability of Northwest oil-by-rail projects. Are we seeing the early stages of the same sort of economic uncertainty that have placed Northwest coal terminals in financial limbo? Could the collapse in Bakken fracking turn massive oil-by-rail proposals into “stranded assets“? Stay tuned!!

Jan Steinman

“Volatility” is the key word.

A lot of people have been banking on “peak oil” being synonymous with “high prices.” But what we’re finding is that the backside of Hubbert’s Curve is not a smooth descent, but rather a nasty, ragged sawtooth, that can cut you if you’re not careful and prepared!

Clark Williams-Derry

Bingo.

Volatility is making it very hard for the oil industry to figure out how to invest…and making it much more likely that many of its investments won’t pan out.

SteveG

All the more reason to wean ourselves off of our petroleum addiction ASAP. Shift to low-carbon modes: walking, bikes, transit and (ideally, shared) electric vehicles.

Robert McDonald

If oil prices are “declining” why is Shell station in Shoreline $3.49, 3.59, 3.69/gallon?

Jeremy

Oil prices have declined; Brent shows a recent dip. Now, oil is not gasoline, and not all crudes equal. Indeed, due to the peak in conventional crude oil and recent craze for tight oil, that oil is getting tricky for refineries to process efficiently:

http://www.reuters.com/article/2015/06/02/usa-refineries-feedstock-kemp-idUSL5N0YO3JA20150602

Note that there’s only so much fiddling that can be done before capital investments become necessary to the refineries; guess who those costs will be passed on to?

Dave Moore

The Bakken oil should be saved in the ground to store carbon to mitigate global warming. Someday after the atmosphere is stabilized it could help produce and deliver food and medicine for future generations. The slower it is developed the better. It also would help the price for the producers. Wasting huge amounts of fuel to export this oil to Asia is nuts.