Search Results

-

Millennium Backers In Dire Straits

The last public “scoping hearing” on the proposed Millennium coal export terminal is tomorrow in Tacoma. But there’s a fascinating story that’s unfolded as these hearings have progressed: the companies promoting the Millennium project have found themselves in increasingly dire financial straits. Let’s start with Arch Coal, which owns 38 percent of the Millennium project. Just last week, Moody’s, a bond rating agency, downgraded Arch’s debt—a move that is likely...Read more » -

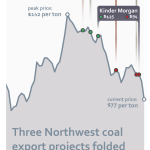

The Coal Export Bubble

There’s been so much news on the coal export front of late—the massive scope of the proposed Gateway-Pacific terminal’s Environmental Impact Statement; the Lummi Nation’s unequivocal opposition to a coal terminal at Cherry Point; and recent revelations about the ongoing financial woes of coal terminal developer Ambre Energy—that it’s hard not to sense that Northwest coal export projects are on the ropes. But perhaps the single biggest story in coal exports over...Read more » -

More Evidence of Morrow Pacific’s Financial Weakness

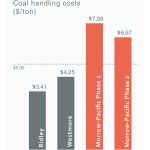

A few weeks back, we released a report on the shaky economic fundamentals of Ambre Energy's Morrow Pacific coal export project. In a nutshell, documents released by Ambre Energy, the project's developer, make the project look like a dud. By handling coal at two separate port terminals, Morrow Pacific incurs higher costs for transportation, operations, and capital than its likely competitors. In fact, the costs are so high that it's not clear that Ambre could make any profit whatsoever selling coal into Asian markets. But apparently we're not the only ones saying that Morrow Pacific's finances are dicey. The project's chief executive is saying the exact same thing. A recent story in Platts Coal Trader, a subscription-only industry journal, quoted Ambre Energy's North American CEO admitting that the project can't make money unless international coal prices rise substantially:

A few weeks back, we released a report on the shaky economic fundamentals of Ambre Energy’s Morrow Pacific coal export project. In a nutshell, documents released by Ambre Energy, the project’s developer, make the project look like a dud. By handling coal at two separate port terminals, Morrow Pacific incurs higher costs for transportation, operations, and capital than its likely competitors. In fact, the costs are so high that it’s...Read more » -

The Morrow Pacific Project

The Morrow Pacific project, a coal export venture being pursued by Australian firm Ambre Energy, aims to ship coal by rail to Oregon’s Port of Morrow on the Columbia River, barge it downstream to a second port, and load it onto cargo ships bound for Asia. Recent financial disclosures suggest that the project would face unusually high costs in three separate areas: High handling costs. Unlike conventional export projects that...Read more » -

Morrow Pacific: The Economics Just Don’t Work

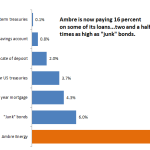

A few months ago we reported on the shaky finances of Ambre Energy, Ltd, the Australian firm that's at the center of two of the three remaining coal export terminal proposals in Washington and Oregon. Ambre's finances paint the picture of a struggling, high-risk start-up: by the end of 2012 the company had burned through well over a hundred million dollars of its investors' money, accumulating massive debts and obligations in the process, yet still hadn't cobbled together even a hint of a profitable business.

But if the company's recent financial disclosures are accurate, our earlier report just scratched at the surface of Ambre's financial woes. Our brand-new look at the finances of Ambre's Morrow Pacific coal export project suggests that one of the company's export proposals is in deep financial trouble, because it faces:

A few months ago we reported on the shaky finances of Ambre Energy, Ltd, the Australian firm that's at the center of two of the three remaining coal export terminal proposals in Washington and Oregon. Ambre's finances paint the picture of a struggling, high-risk start-up: by the end of 2012 the company had burned through well over a hundred million dollars of its investors' money, accumulating massive debts and obligations in the process, yet still hadn't cobbled together even a hint of a profitable business.

But if the company's recent financial disclosures are accurate, our earlier report just scratched at the surface of Ambre's financial woes. Our brand-new look at the finances of Ambre's Morrow Pacific coal export project suggests that one of the company's export proposals is in deep financial trouble, because it faces:

- Higher transportation costs than any nearby competitor;

- Higher handling costs than existing coal terminal projects in the region; and

- Greater capital costs than comparable export terminal projects.

A few months ago we reported on the shaky finances of Ambre Energy, Ltd, the Australian firm that’s at the center of two of the three remaining coal export terminal proposals in Washington and Oregon. Ambre’s finances paint the picture of a struggling, high-risk start-up: by the end of 2012 the company had burned through well over a hundred million dollars of its investors’ money, accumulating massive debts and obligations...Read more » -

Coal Exports: Two Weeks of Good News

It’s been a busy—and from my standpoint, mostly heartening—few weeks on the coal export front. When you string together all the new developments, there are more and more signs that coal export proposals are on the ropes. Here’s a quick summary of the Terrible, Horrible, No Good, Very Bad Fortnight for would-be Pacific Northwest coal exporters: March 24, 2013 (Seattle, WA): WA Governor Jay Inslee and Oregon Governor John Kitzhaber submitted...Read more » -

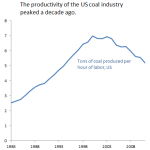

The Coal Industry’s Falling Productivity

Interesting factoid: an hour of labor produces about 25 percent less coal today than it did a decade ago. Declining labor productivity means rising costs and slimmer profits for coal companies—adding to the woes of an industry that’s already reeling from slumping demand. But it’s not like the coal industry is doing something wrong to make productivity fall. It’s mostly a matter of geology: like any industry, coal miners started on the easy...Read more » -

Weekend Reading 2/22/13

Eric My top recommendation this week is “The Extraordinary Science of Addictive Junk Food,” a feature piece by Michael Moss at the New York Times Magazine. I have a pronounced weakness for certain kinds of junk food—chips most of all—so I found it especially alarming to read in some detail about the well-funded research that develops foods specifically targeted to make us eat far more than we should. That the...Read more » -

No, the Coal Will Not Just Go to Canada (episode 9,274)

Note: I’m going to continue updating this post as I come across new pieces of evidence. At a Seattle Town Hall forum last week, SSA Marine VP Bob Watters’ claimed again—and despite much evidence to the contrary—that it doesn’t matter whether his firm builds a huge coal terminal near Bellingham. According to this theory, if Oregon and Washington communities don’t ship the coal then British Columbia ports will simply export...Read more » -

Look Who’s Taking Coal Money, Part 2

Excellent. At Seattlepi.com, Joel Connelly runs with with this story in a strong piece, “Northwest’s so-called ‘green’ law firms working for Big Coal.” If ever an industry needed lawyers, it’s coal. Widely despised for the range of harm it leaves in its wake—from asthma in kids to mercury in fish to dangerous drinking water pollution—the coal industry long ago became dependent on law firms to run interference with the rules...Read more »