Series: Non-Cascadia Climate Action

Original Sightline Institute graphic, available under our free use policy.

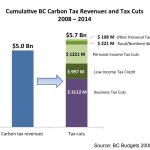

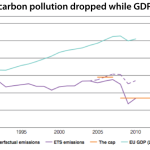

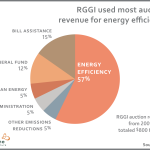

Cascadia has many examples to look to globally as we refine or develop our own climate policies. This series collects our research on how regions outside of the Pacific Northwest are working to hold polluters accountable and reduce their climate-warming carbon pollution and advance their economic growth.