Editor’s note: Earlier posts in this series used the figures $63 and $41 million in referring to the size of the loophole. The $59 million figure used below draws on newly available calculations from the WA OFM.

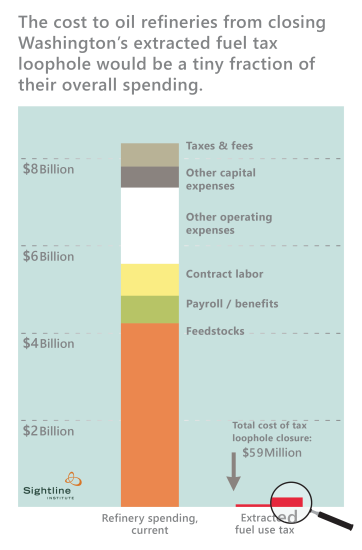

Facing a Supreme Court order to fund public education, Governor Inslee and others have combed through the state tax code in search of outdated and perverse tax loopholes. Perhaps none of them is more bizarre than the “extracted fuel use tax exemption”—a purely accidental giveaway to oil refineries that costs the state $59 million each budget cycle.

Oil companies are stalling to prevent paying the same taxes everyone else does, even though the cost of closing the loophole would represent only a tiny fraction—less than 1 percent—of their overall costs.

Closing the loophole makes sense, as a means to both fund public education and inject a modicum of fairness into the state tax code. What’s more, the tax benefit, which dates to 1949, was never intended for oil companies in the first place. In fact, the law was written for sawmills at a time when there were no oil refineries in the state.

It was only later that refiners moved into Washington and exploited the tax code’s loose language so thoroughly that they now claim 98 percent of the benefit.

Fortunately, there’s a bill in the legislature that would close the loophole and redirect the money to classrooms. I’ll be testifying on it before the House Finance committee on February 6 at 8 am.

You can find more information about the tax loophole in this blog series, and also here:

- SIGHTLINE FACT SHEET: Washington’s Extracted Fuel Tax Loophole

- What Big Oil’s Tax Break Costs Our Classrooms

- Hog-Wild Loophole

- The Accidental Tax Loophole

- Office of Financial Management’s 2014 “Tax Exemption Fact Sheets”

- The Joint Legislative Audit and Review Committee (JLARC) assessment

Karen Y Hogan

this is totally wrong to give any business tax breaks that cost us the citizens (people) of this country and State extra money. It is not a balance that they create. They come with promises and leave us with the mess to clean up, pay for and we loose all the way around. While they walk off with all the money, profit’s that cost us. This needs to end, Close all the loopholes and stop the lobbying payoffs also. If it is a good business it should be able to stand on its own credits and good will and honest work. leaving a clean environment and be safe for all living here.

Bastiat

And…??? Dont leave us all in suspense here Mr. de Place!

How’d the testimony go last week?

Eric de Place

You know, I think it went pretty well. In a sense there’s really not a lot to say about this loophole: it’s a plainly unjustifiable giveaway to an industry that doesn’t need it, and it robs our students of resources they deserve.

The oil industry doesn’t see it that way, so they’re doing what they can to obfuscate, delay, and politicize.

You can watch the hearing here:

http://www.tvw.org/index.php?option=com_tvwplayer&eventID=2014020038