In case you missed the news on Monday, the Oregon Department of State Lands denied a crucial permit for Ambre Energy’s plans to build a coal export terminal along the Columbia River capable of shipping 8.8 million tons per year.

It’s hard to overstate the significance of this ruling. It’s the first major regulatory decision on any coal terminal permit in the Northwest states. It was an unambiguous victory for opponents of coal export terminals, particularly the tribes that have been so vocally opposed to coal export facilities on the Columbia. And it foreshadows the likely outcomes for the much larger, more complex, and higher-impact projects that are still in the early stages of the permitting process.

Though the company may appeal the decision, the odds are stacked against Ambre: the path forward is unclear and likely lengthy; the company is struggling to raise sufficient additional financing; international coal prices are low; and recent developments in Asia show uncertain demand for US exports.

Of course, none of this is news to Sightline readers. You’ve been reading about Ambre’s shaky finances since late 2012, and the news has only gotten worse. It’s been a long road, but with this happy event, we can’t help but take a fond look back (and yes, feel free to crank up some victory tunes) at some of the research that helped get us here:

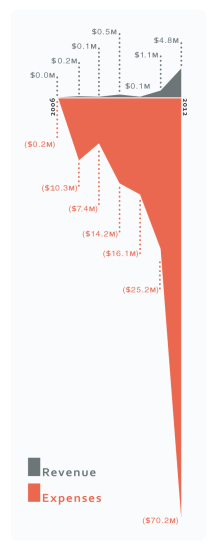

- Ambre Energy: Caveat Investor: Our first big foray into exposing Ambre for the financial house of cards it is. Just look at that chart! Bonus: Ambre’s not-so-graceful response.

- The Morrow Pacific Project: A follow-up report focused on the company’s dismal-looking Morrow Pacific coal export terminal plan: high costs in handling, transportation, and capital put the project at major competitive disadvantage. Funnily enough, Ambre’s own CEO agreed with our analysis!

- Financing failure in lawsuit: In mid-2013, Ambre Energy scrambled to come up with cash to settle a lawsuit with rival company Cloud Peak Energy. Ultimately, they never raised the money.

- We called out Ambre for being suspiciously secretive about its finances and soon learned partly why: on some of its loans, it was paying over two-and-a-half times the interest rate of “junk bonds,” an indication of how little faith investors had in the company’s plans.

- Meanwhile, Wall Street investment in coal export projects started drying up—the big boys of finance saw the writing on the wall; coal prices collapsed in the Pacific Rim market, on which companies like Ambre were depending; and even just the cost of mining Powder River Basin coal was rising.

Oregon DSL’s decision Monday was an important one not just for the Northwest—our region sent a death shudder through the coal industry nationally. The coal industry, for all of its financial travails in recent years, still held out hope that Asian exports would save their business. But now, both coal industry execs and the would-be investors in coal terminal projects have to come to terms with the fact that the odds just aren’t in their favor.

J C

Many of us in the NW have been working with Greenpeace and Beyond Coal to stop the shipment of dirty coal through out beautiful communities. Thank goodness speaking and appearing at hearings and letter writing have hopefully stopped Ambre Energy’s foray into our communities with the transport of environmentally damaging coal.