For more than two years, the US coal industry has predicted that international coal prices would soon rebound, breathing new life into coal export and mining proposals that are now languishing on financial life support. But despite the industry’s hopes, the bottom keeps falling out of the global coal market.

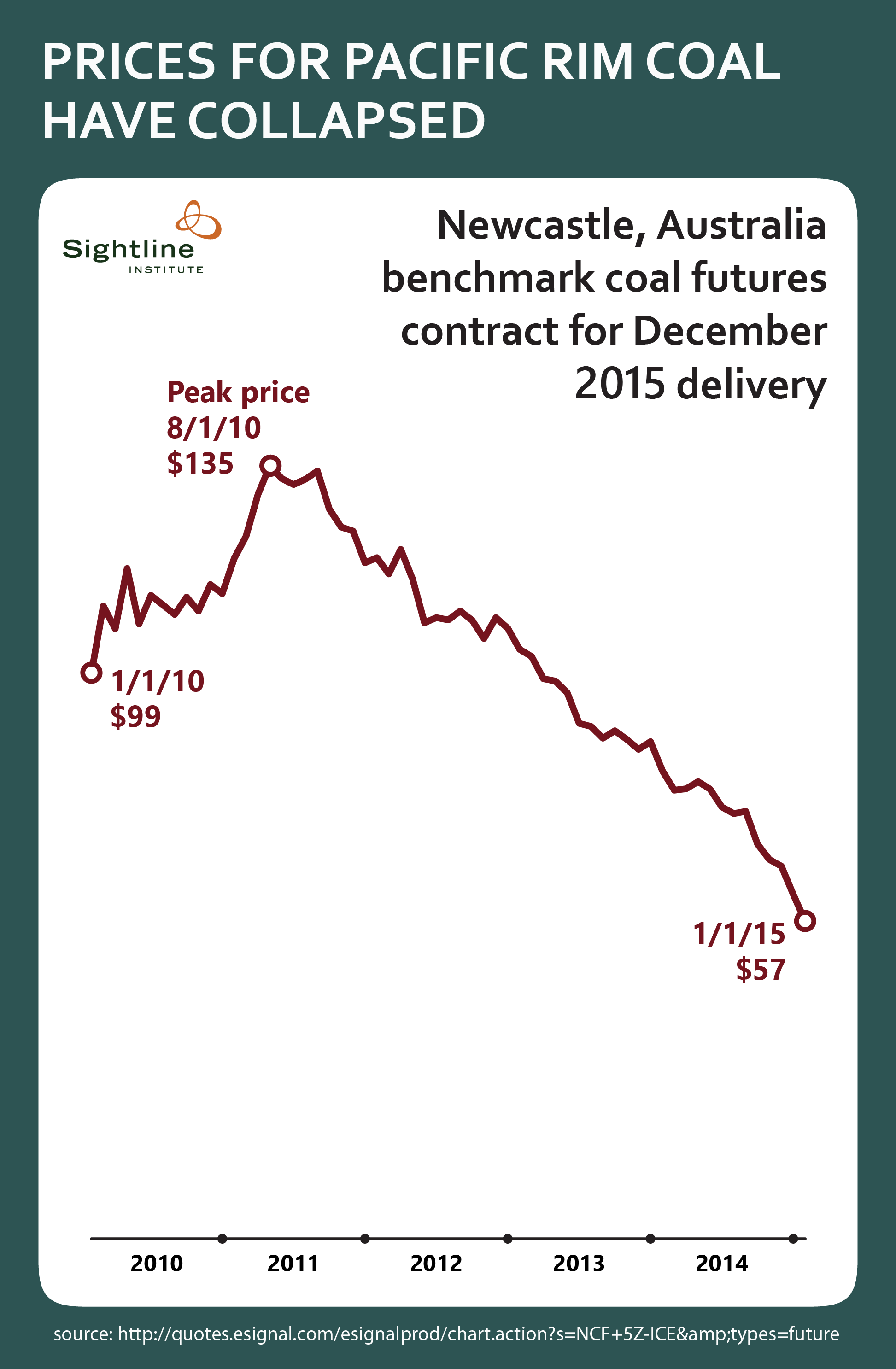

Market conditions for Pacific Rim coal exporters are now worse than they’ve been since the depths of the global recession. After peaking in early 2011 at more than $130 per ton, the price of benchmark Australian coal has fallen for nearly 4 consecutive years. In December, they reached a 5-year low of $62 in December, according to the World Bank.

But the futures market predicts that the worst is yet to come. The futures price for December delivery of Australian coal has fallen to $57 per ton, with the price collapse accelerating in recent months.

Original Sightline Institute graphic, available under our free use policy.

The collapse in Pacific Rim coal prices has stemmed from a combination of rising supply and falling demand for coal on seaborne markets. These are deep, structural trends rather than cyclical ones and are unlikely to reverse in the short- or mid-term.

When coal prices were high in 2010 and 2011, coal producers in Indonesia, Australia, and other Pacific Rim nations ramped up production, flooding the market with low-cost coal. Meanwhile, China undertook an intensive program to modernize its coal industry, boosting production while improving energy efficiency. With supplies rising faster than demand, coal prices fell steadily, even as Chinese coal import volumes continued to rise.

More recently, China has enacted new policies designed both to protect its domestic coal industry and to reduce coal consumption in smog-choked coastal provinces. These policies are working: China’s customs department reports a 22 percent year-over-year decline in coal imports in the second half of 2014, which has helped drive Pacific Rim coal prices to multi-year lows. Additional policies, such as a national cap-and-trade program that is scheduled to launch in 2016, are likely to maintain downward pressure on China’s coal demand.

Falling coal prices are terrible news for the coal industry’s export plans in the Pacific Northwest. Last year, the CEO of US coal exporter Cloud Peak Energy admitted that the company needs to see Australian coal prices between $80 and $90 per ton in order to break even selling coal to Asia. The company’s export arm has been losing money on coal sales since the middle of 2013, but continues to export largely because it is locked into long-term rail and port contracts.

Collapsing coal prices have had other financial repercussions as well. Ambre Energy, the main proponent of two of the three remaining coal terminal projects in the Northwest states, admitted in recent regulatory filings that low international coal prices contributed to the company’s financial implosion. Facing imminent bankruptcy, Ambre recently sold its entire North American coal operation to creditors at a price less than a tenth of what the company claimed it was worth the prior year. Meanwhile, Canada’s Ridley coal export terminal has suffered financially catastrophic cutbacks in coal shipments, as some of the terminal’s main customers shuttered their mines, unable to make a profit in a sinking market.

As coal export prospects dim, the largest US producers that are focused on Northwest coal exports, Peabody Energy and Arch Coal, are plumbing new depths on Wall Street. Investors who put a dollar into Peabody in April 2011 would now have about 8 cents left; for Arch, their “nest egg” would be closer to 3 cents. These companies face crushing debt loads from ill-timed acquisitions near the market top.

The bottom line: coal exporters looking for a light at the end of the tunnel are facing hard truths in global coal markets. And Northwest communities should think hard before betting on a 19th-century commodity as a foundation for 21st-century prosperity.

Michael Riordan

That curve doesn’t look linear to me; it looks like it’s turning down! For us geeky mathematicians and physicists, it seems to have a negative second derivative.

Clark Williams-Derry

I think it was roughly linear until last June-August…which was when China’s imports started to collapse. After that, you saw a faster downturn.

Then again, if do a log-linear plot (which sort of makes sense for price movements), even a linear price decline can looks like it has a negative second derivative.

Barry Saxifrage

Another good article on carbon bubble, thanks.

I find it interesting how much faster coal company stock prices are falling than coal prices. We aren’t seeing that yet with oil … despite similar scale in commodity price drop. Makes me think the market really does believe that coal prices are going to be low for a long time to come.

Clark Williams-Derry

Here’s one reason why that may happen: coal industry profits are calculated based on the price of coal minus the cost of production + transportation. So if coal prices are $50 and costs are $40, then a $10 drop in prices (just 20%) leads to a 100% drop in profits.

In fact, this means that a steady linear drop in prices leads to an accelerating collapse in profits. (I’ll be happy to provide an example, but not tonight!)

Steve Harrell

Much as I like what you say, there are still cautions about China’s coal market in the medium-term. IEA projects that China’s coal demand will grow 2.6%/year for the next few years, until energy efficiency and development of other sources of electric power can start to meet all the increasing demand and start replacing coal. Whether the increased demand is filled primarily from domestic or export production, they say, will depend on markets. So we’re not out of the woods on the export to China issue yet.

Clark Williams-Derry

Yeah, it’s always wise to be cautious. Still, IEA was saying more or less the same thing last year, and coal consumption fell by about 2%. So they’re already nearly 5% off in 2 years. Meanwhile, China’s heavy industry output is falling sharply, at least for now. And Chinese coal imports are down 53% this January compared with Jan. 2014.

So I totally agree, we’re not out of the woods! But still, the trends are changing quickly, and I don’t see much reason to think that IEA has a particularly accurate read on the trends. They’re simply wrong too often.

william

For more than two years, the US coal industry has predicted that international coal prices would soon rebound, breathing new life into coal export and mining proposals that are now languishing on financial life support. But despite the industry’s hopes, the bottom keeps falling out of the global coal market.