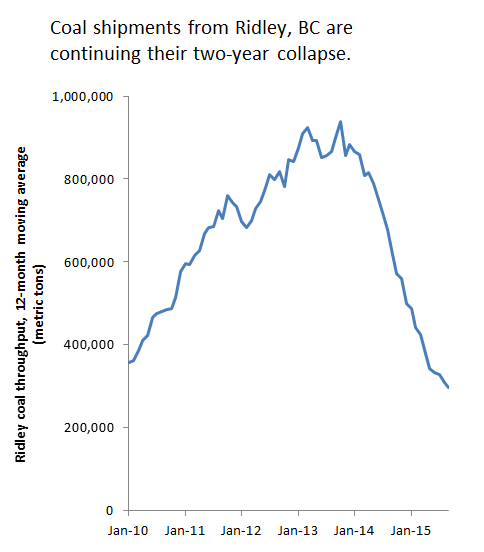

In case you were wondering, the bad news for coal exporters keeps rolling in. Take, for instance, the latest figures from the Ridley coal export terminal in northern BC:

Original Sightline Institute graph, available under our free use policy. Data from Port of Prince Rupert.

Clearly, the precipitous decline in coal exports from the terminal is still underway. Metallurgical (steelmaking) coal had been the mainstay of the terminal since 2010, accounting for more than two-thirds of the port’s coal volume. But in September, Ridley didn’t ship a single ton of metallurgical coal.

The obvious culprit for the collapse at Ridley: low international coal prices. Asian coal markets have abundant supplies but meager demand—particularly from China, where coal imports have fallen, year-over-year, for 15 consecutive months. Demand has been so weak that major exporters are starting to trim production: Indonesia’s coal industry, for example, reduced its output by more than 15% through August.

With China giving strong indications that further cuts in coal are in the offing, at this point there’s little reason to believe that the coal export bubble will re-inflate any time soon. Which makes me wonder why the developers of the costly coal terminal proposals in Washington and Southern BC don’t just give up.

Comments