Hazy bubble by zacktionman used under CC BY-NC 2.0

It’s funny to re-read the coal news from last year, full of confident “experts” predicting a rebound in international coal prices. Here’s one story, asserting that international coal prices had “hit rock bottom”. And another, predicting a “modest recovery” in coal prices by the end of 2015. And yet another, arguing that Asian coal demand was set for “a robust revival.”

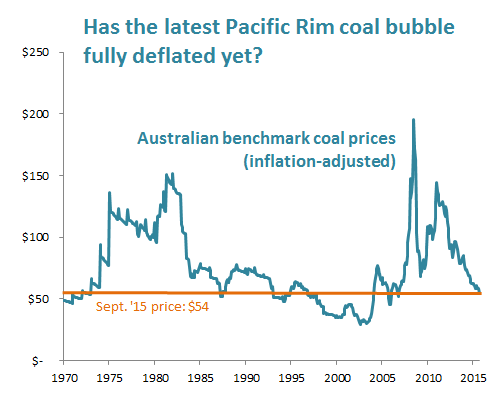

I could go on. Meanwhile, back in the real world, coal prices have continued to sink throughout 2014 and 2015. Australian benchmark coal prices were in the mid-$70s when these analysts were predicting a rebound. But as of a month ago they had fallen all the way to $54 per ton and have headed down since.

Given how far international coal prices have fallen over the past few years, is it possible that they’re finally near the bottom now?

I’m not even going to try to answer that question. Markets are just too unpredictable.

I will say this, though: today’s “low” international coal prices aren’t all that unusual. Take a look at the chart to the right, showing inflation-adjusted prices for Australian benchmark coal from 1970 through last month. As you can see, as of one month ago (the orange line), international coal prices remained well above their inflation-adjusted levels from 1997 through 2003. They were also above the average coal price from 1990 through 2007. In that context, today’s prices look relatively normal, and the “bubble” years—the energy crunch of the 1970s, the global commodity price spike in 2007, and the Chinese coal bubble in from 2009 through 2013—are the periods that look unusual.

Given the multi-decade price decline after the coal bubble in the late 1970s and early 1980s, and the persistent oversupply and weak demand in today’s Asian coal markets, it’s entirely plausible that Pacific Rim coal prices could continue to drop for years.

But what this chart also makes clear is that coal prices are volatile. They can spike and collapse rapidly and unexpectedly, defying the confident predictions of experts.

Typically, this sort of volatility is a major downside for an industry. It’s awfully hard to make long-term plans if you can’t tell whether prices will be $50 or $150.

But at this point, with prices as low as they are, a history of wild price swings may offer a slender ray of hope for the coal industry. Take, for instance, the coal companies operating in the Powder River Basin of Wyoming and Montana. At today’s prices, it’s simply impossible for them to make money selling coal to Asia. The best positioned of those companies, Cloud Peak Energy, is losing money hand over fist on its exports. But the coal market’s history of volatility holds out the possibility that, just maybe, there could be another coal boom a few years down the road, bringing along hefty profits in its wake.

So paradoxically, the sort of volatility that most investors shun—cycles of boom and bust, with get-rich-quick dreams suddenly descending into head-for-the-exit nightmares—is precisely what’s fueling the hopes of the would-be coal exporters who are still pushing forward with coal terminals in the Pacific Northwest.

John Bremer

Developing countries are building coal plants, adding to the infrastructure that will be processing CO2 from coal for decades.

J Butler

The bubble is still deflating. It is pretty amazing what California has done in reducing coal use and emissions.

http://www.energy.ca.gov/renewables/tracking_progress/documents/current_expected_energy_from_coal.pdf