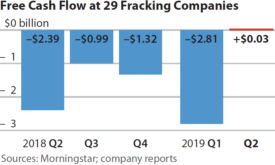

A cross-section of 29 fracking-focused oil and gas companies reported meager cash returns in the second quarter of 2019.

Only 11 of the 29 companies reported positive free cash flows. All told, these publicly traded firms generated just $26 million in aggregate free cash flows—far too low to make a significant dent in the more than $100 billion in long-term debt owed by these companies, let alone reward equity investors who have been waiting for a decade for robust and sustainable cash flows from the fracking sector.

Yet as disappointing as these results were, they represented the highest quarterly cash flows for oil and gas producers in years.

Free cash flow—defined as a company’s operating cash flows (i.e., the amount of cash generated by a company’s core business) minus its capital spending—is a crucial gauge of financial health. Positive free cash flows allow companies to pay down debt and reward stockholders. Negative free cash flows, in contrast, force companies to fund their operations by dipping into cash reserves, selling assets, or raising new money from capital markets.

Last quarter’s cash performance—just a hair over breaking even—would count as a bitter disappointment in virtually any other sector of the economy. Yet for an industry that has posted negative cash flows for a decade, these mediocre results represent a financial high-water mark. Even so, stock market investors have continued to punish the sector: over the past 3 months, a leading ETF (exchange-traded fund) for oil and gas producers fell more than 26 percent, even as the broader S&P 500 index rose by nearly 3 percent. Clearly, investors are losing faith in the oil and gas industry after decades of cash losses.

More: Accounting tricks hide fracking’s biggest secret

Two factors improved the industry’s performance during the quarter. First, the US oil price benchmark rose by roughly 9 percent compared with the first quarter of the year. Higher oil prices boosted revenues and operating cash flows, particularly for oil-focused exploration and production companies. However, prices have since moderated, portending lower realizations from oil and gas sales in the third quarter. Second, the companies in our sample trimmed capital expenditures from $14.9 billion in Q1 to $14.4 billion in Q2. This modest capex cut pushed the sample’s cash flows into positive territory.

Frackers’ persistent inability to produce robust cash flows should be a grave concern to investors. A healthy industry would generate enough cash not only to sustain its own capital spending, but also to pay off debt and reward stockholders—all while maintaining or even increasing its output to support rising stock prices. Until fracking companies can demonstrate that they can produce cash as well as hydrocarbons, cautious investors would be wise to view the fracking sector as a speculative enterprise with a weak outlook and an unproven business model.

Key findings:

- US fracking-focused oil and gas companies reported a mediocre second quarter.

- A cross-section of small and mid-sized US oil and gas producers reported a mere $26 million in free cash flows from April through June 2019.

- Disappointing cash flows have soured investors on the sector, constraining the oil and gas industry’s ability to tap debt and equity markets.

Full research brief: “US Fracking Sector Disappoints Yet Again”