Sound Transit Bus 554 makes its first non-freeway Seattle stop at 5th and Jackson in the International District. A first-time Seattle visitor departing there is greeted not by a vibrant streetscape, but by five vast surface parking lots: a bold but disappointing proclamation that even in the transit-friendly urban core, the car is still king.

Could a land-value tax help dethrone the automobile?

201 5th Ave S, International District, parking lot at 5:35 pm. Image by Jerrell Whitehead (used with permission).

Sightline has argued time and again that municipal parking rules have distorted housing markets and jacked up the price of rental housing. But the surface parking lots that dot the Northwest’s major cities are a symptom not so much of misguided parking rules, but largely of something else: land speculation.

Consider the lot to the left, at 500 S Main St. It’s right in the heart of Seattle’s International District and just a few blocks from Safeco and CenturyLink Fields. Owned by Fujimatsu LLC, the lot measures 27,000 square feet, about half the size of a football field. When I visited shortly after noon on a recent week day, 77 of its 100 spots were in use. By 5:30 pm, the picture speaks volumes: the lot was nearly deserted.

Although the lot’s owners have done very little to the property for years, it’s still been a sound investment. For 1998-99, King County appraised the two adjacent lots at $720,000 and $693,000, respectively. By 2014-15, those numbers had shot up to $2,016,000 and $1,764,000. Despite years of neglect, the value of the land nearly tripled. And that’s just the assessed value. Real-world property values (and gains) often far exceed the county’s assessments.

The reason the value of these lots grew so quickly is simple: nearby landowners and businesses, as well as the city government, invested in buildings and infrastructure that made the entire neighborhood more desirable. The lot owner does almost nothing to contribute to rising property values in the neighborhood. In fact, for most parking lots, the county finds that the “improvements” on surface lots are literally worthless, contributing no economic value.

Another surface lot example is found between 4th and 6th Ave S, where Sweazey Investments LLC owns 31,050 square feet of lot space, totaling 143 parking stalls. At 12:50pm, 25 stalls were available, but by 5:40 pm, the picture shows plenty of spots available. Similar to the above lot, valuable Seattle land sits vacant, a quiet testimony to ever present land speculation. But the business numbers again add up perfectly for the land holders, with the assessed land value going from $1,314,000 in 1998-99 to $4,347,000 by 2014-15.

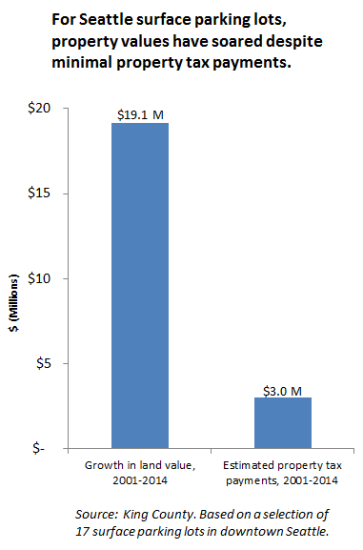

Looking at 17 different surface parking lots that I found by walking around downtown Seattle, I saw the same pattern repeated over and over. County records suggest that the aggregate value of those lots more than doubled between 2001 and 2014—figures that may be conservative. And just as importantly, the gains in land value outweighed estimated property tax payments over the period by a factor of 6. In short, for every dollar these property owners paid in property tax, the value of their property grew by $6. Quite a hefty return for doing nothing.

These examples suggest a simple formula for land speculation:

- First, claim a well-situated plot of land, and use it to create your very own asphalt jungle.

- Second, hold onto the land as your neighbors build housing and office space nearby. Those investments increase the number of people attracted to the neighborhood, boosting your property value. The new buildings also massively increase the amount of property tax those neighbors have to pay.

- Third, continue to sit idle while city and county governments use increased property tax revenue to invest in transit, streets, utilities and other public amenities, further pumping up the value of land.

Feel free to keep at steps 2 and 3 for as long as you like! As long as the revenue from your little plot of surface parking pays for your property taxes, you’ll be happily free-riding on the efforts of your neighbors. Their actions boost the value of the land…and you reap the benefits.

A land-value tax—described on this blog last week—would encourage owners like Fujimatsu LLC and Sweazey Investments LLC to use their land for something other than a surface parking lot. It would ramp up property taxes on idle land, making it much harder for landowners to make money keeping their land inactive. LVT is not some sort of panacea for the Emerald City. But as a tool for incentivizing smart urban development and spurring infill in depressed areas, it might quickly prove its worth.

Matt the Engineer

I always feel like I just can’t quite wrap my mind around the implications of LVT. I think I’d be a supporter if I understood more of the details. I’ll list some of the largest questions that have been bugging me:

We certainly won’t add demand for all of these new buildings it would presumably create. Does this just mean rents precipitously drop? If we’re putting in much less rent, and they’re putting in much more in taxes and construction… that seems like a mismatch. Will we really be taking enough of their profits to make up the difference, or will other strange effects pop up?

Speaking of strange effects, what happens if you just don’t think you can make enough off your property for the new taxes? I suppose you’d forfeit your property to the government. Will we end up with vast tracts of government owned property for areas with too high of taxes to be profitable? I suppose some of that goes back to my main question:

How on earth would the city come up for a fair land value price? Value is really only how much one party is willing to pay another for something, and the only real way to determine this is to sell it. You can have a very valuable property right next to a near worthless one, and I’m a little worried about weather the city would be sharp enough to know the difference. Being wrong would make instant winners and losers in a market.

Thinking further about determining the price, doesn’t that set us up for corruption? Unless we come up with rigid rules in determining values (and if I could do that I think I’d be pretty rich), it’s going to be up to some person to make value judgments on land prices. That could be a very, very lucrative political position.

Richard

Good questions Matt. Jerrell’s articles are some of the best I’ve read on lvt.

Your first question. It helps me to think about gradually raising taxes on the rental value of the land and decreasing taxes on the improvements. The owner’s net tax will change little until the tax on land becomes greater than the tax on improvements.

2nd question. If an owner decides that paying full rental value on land is unprofitable they are more likely to sell (not yield to government). An owner will attempt to maximize profit on the land sale but the land market will determine the sale price. Note that there will be more price competition with this scenario because it will be less profitable to “buy and hold” and this puts a damper on speculation.

3rd and 4th. Under lvt nothing changes the fact that the market sets prices based on the rental value of the land. (I just looked and wikipedia has a good article on lvt.)

It helped me to realize that land is a unique economic commodity; you can’t move it and you can’t make any more of it. In spite of that you can hold title to it in perpetuity (monopolize it). Under the current rules speculators are the “winners” and the rest of us lose the economic use of land.

I hope this helps. Maybe Jarrell will clarify.

Richard

Mickymse

My problem with arguments like this is that most of the parking lots around Downtown clearly were NOT just about land speculation. Sure, I don’t follow land sales at all to know if they’ve changed hands in recent years; but my point is that the vast majority of these lots have been lots for some time. And, as you point out in the article, they’re making good money for the service of providing workforce parking.

I don’t diagree that they could be BETTER utilized, but they’re not failing at their task. And why should we force landowners to convert property just because we don’t like the current use. Why is that any different a motivation from those residents who want to resist owners trying to build dense developments outside of the Downtown core?

Are there many agregious examples of this other than the parking lot at 3rd & Pine(?) which was paved over while a developer held onto the land or the famous example of the destruction of the Cadillac Hotel to be replaced by the “Sinking Ship” garage? Or I’d much rather have a parking lot than the stupid hole across the street from city Hall which has been there for, what, over a decade now?

Jerrell Whitehead

Mickymse,

Thank you for your response and interest in LVT. The destruction of Hotel Seattle was done in 1961-62 and was, predictably, a political decision made in order to revitalize Pioneer Square. The hotel (then an office building) was replaced with the Sinking Ship parking garage with the thinking that other garages would follow. Decisions like this are made when the car is seen as the primary mode of transportation.

And as Richard mentions, under an LVT, the gigantic hole currently at 4th and Cherry would not exist, since the property owners would be forced with a tough decision – hold onto the land or build with a quicker timetable.

Richard

Mickymse,

Actually these parking lots are typical of land speculation. Land speculation is very common. All anyone has to do is buy and hold land in places where the locational value is expected to increase and follow the 3 steps outlined in the article. Remember, “Location! Location! Location!”? That’s why the majority of these lots have been lots for some time; location, low overhead, low taxes.

No doubt the owners are making good money for providing parking. But they are not paying taxes to cover their share of costs of services provided to the lots and the community. Yes they could be better utilized, provide more service to the community and make more money for the owners. The key to land value taxation is that it makes the land market function like all other markets where price competition determines values. If the owners had to pay taxes on the rental value of the land they would make better use of it.

Concern over higher density housing is about zoning not land value taxation (lvt). Under lvt fewer choose to “buy and hold” instead they put land to more economic use. A more competitive land market would help keep Downtown land prices competitive with land prices outside Downtown. This won’t solve the problem of disgruntled neighbors but higher density housing is more likely to be built closer to Downtown.

The paved over parking lot may be the result of undervaluing the land. Destroying the Cadillac Hotel to put up a parking garage happens when economically productive land is sacrificed when we value car transportation over other modes. The hole across the street from City Hall would most certainly not have been there that long if the owner was required to pay taxes on the rental value of the land.

These are excellent articles on land value taxation and there is plenty of information on the web. It’s an old concept and still very valid.

Jon Morgan

Land-value tax is the wrong tool because it discourages the dense, tall, mixed-use development we want. As I’ve been saying for years, what we really need at least around transit nodes is a split-rate property tax. Tax the land heavily and any buildings on it lightly. This encourages efficient land use and makes wasteful land-banking less economical (see SCCC on Capitol Hill for more good examples). You can’t replace something with nothing; split-rate property taxes make it easier to get rid of gas stations, auto dealerships, parking lots, etc. in favor of good urban development.

Jerrell Whitehead

Jon,

Actually, I believe we are in agreement on this point. The LVT can in fact be used to create the exact type of mixed-use development you mention. Moreover, an LVT can be designed in the very manner which you state, as a split-rate or dual-track system. Throughout Pennsylvania, this is the form of LVT most often in use. All that is needed is a heavier tax on land than on buildings. Arguably, this is likely the best way to proceed towards a ‘pure’ LVT, rather than just jumping straight into that system of taxation. It might be easier to achieve as well, since it is not the wholesale adoption of a ‘new’ tax regime that has to be explained to voters.

As the article states, an LVT will most definitely help in ridding the urban landscape of parking lots, and as you state, other land-reliant users like auto dealerships, e.g. BMW Seattle.

VeloBusDriver

“What about a tax on free parking?” – If only the LVT was part of the ‘Save Metro’ discussion. Far better than the ‘head tax’, I’d venture to say. Tax what you want less of (vacant land/underutilized parking lots rather than what you want more of (employees/commerce/vitality)

Jerrell Whitehead

If there were only such a thing as free parking. Someone has to pay!

Read more here: http://www.sightline.org/blog_series/parking-lots/

And I agree with you on the latter point. There is only so much you can tax business before a litany of negative consequences results.