Washington House Democrats recently threw a ball by failing to include badly needed carbon revenue in their proposed budget. There may still be time to get carbon revenue back on the table, but a relief pitcher is warming up, just in case. In March, CarbonWA, a grassroots group, filed ballot language with the Secretary of State, and now supporters are out gathering signatures and raising money to put it on the 2016 ballot.

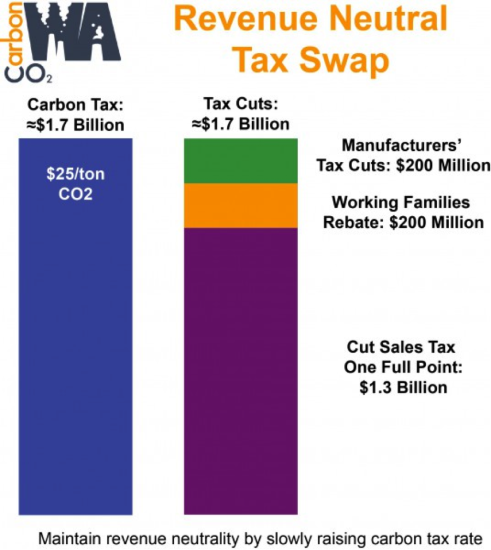

CarbonWA’s Initiative 732 is modeled after British Columbia’s successful carbon tax: it would tax pollution and use all the revenue to cut other state taxes. The CarbonWA tax would start at $15 per ton, rise to $25 per ton in year two, and then slowly and steadily increase by inflation plus 3.5 percent each year. The roughly $1.7 billion in annual revenue would:

- Reduce the state sales tax from 6.5 percent to 5.5 percent.

- Eliminate the business and occupation (B&O) tax for manufacturers.

- Fund the Working Families Rebate to provide up to $1,500 a year for 400,000 low-income working households.

Here’s what you need to know about what CarbonWA’s proposal would mean for Washington:

1. Most households’ total tax bill would not change.

A $25 per ton carbon tax plus a lower sales tax would mean most Washington families would spend a few hundred dollars more in energy prices and would save a few hundred dollars on sales tax. By taxing pollution instead of commerce, Washington could spur the transition to clean energy at no cost to most Washingtonian taxpayers.

If you live in Washington and want to know what the tax swap would mean for you, you can find out from the University of Washington’s tax swap calculator.

2. The Working Families Rebate would make Washington’s tax code more progressive.

Washington has the most regressive state tax system in the United States: the lowest-income families pay nearly 17 percent of their income for state and local taxes, while the richest families pay only 2.4 percent. CarbonWA’s proposal would start to fix that by paying for the never-funded Working Families Rebate. This tax break would reduce the tax burden on a working family with two children from 17 percent to 6.8 percent of income and would constitute the biggest improvement in Washington tax progressivity in almost 40 years.

3. By making polluters pay the true costs of pollution, the carbon tax would spur Washington’s transition to clean energy.

By ending the free lunch for polluters, CarbonWA’s tax would move Washington’s economy in the right direction. British Columbia’s eight-year experience with taxing pollution indicates that a tax of $10-30 per ton can cut fuel use much more than predicted without negative economic impacts. Current prices for electricity from coal, natural gas, and renewables indicate that CarbonWA’s $25 per ton could significantly shift the electricity sector toward less-polluting sources.

A steady and predictably rising price on pollution could usher in an orderly transition to clean energy for free for most households, with the added bonus of improving Washington’s woefully regressive tax code. Win.

Don Steinke

Putting a price on carbon is the most important thing we can do in the Pacific NW . . . that and stopping the expansion of coal and oil transportation.

Please volunteer to help put Initiative 721 on the ballot.

If you live in the Vancouver area contact Roy@carbonWA.org

For the rest of the state, contact Duncan@CarbonWA.org

Don Steinke

oops, it should be I-732.

Also . . . this proposal is revenue neutral . . . no net tax increase.

Ron Hawk

Following are comments re Ms. Ebehard’s article:

1 Carbon WA’s proposal can only be described as “revenue-neutral” if all the carbon taxes collected are offset by tax eliminations or tax rebates. This is not the case, since a portion of the revenue is proposed to fund the Working Families Rebate law, enacted six years ago but never funded by the Washington Legislature. This law is not a rebate but a plan to help working families get through the “Great Recession” by paying them from State funds a percentage of the earned income tax credit declared in their federal income tax returns. It has nothing to do with Washington State taxes. Voters are misled by calling the CarbonWa proposal “revenue-neutral.”

2. Ms. Ebehard does not inform readers that funding of the Working Families Rebate law would require regular separate appropriations by the legislature. It would not occur automatically. And recent proposals by legislators to divert marijuana tax collections for purposes not listed in the voter approved marijuana initiative, raises the possibility that this could also happen with the CarbonWa proposal to dedicate revenue to the Working Families Fund.

3 Ms. Ebehard does not discuss the impact of the proposal to eliminate the B&O tax on Washington’s manufacturers. I cannot support this idea without knowing the businesses who have the most to gain. This could be a big giveaway to a few Washington corporations who are also big polluters.

4 I have heard several times that the proposal to reduce the Washington sales tax rate by one percent will save Washington families a few hundred dollars a year. I would like to see the data that supports this view. In order to save $200 to $300, the average Washington family would have to spend $20,000 to $30,000 annually on sales taxable items. Please show me the proof that after paying their rent/mortgage, basic utility, insurance, medical, grocery and other tax exempt expenses, the average family has $20,000 to $30,000 left to buy goods and services covered by the sales tax.

5 I hope Ms. Ebehard will describe in a future article how the carbon taxes are collected by the State in the CarbonWa proposal. Are they collected at the producers level, i.e., at the refinery, or at the gasoline pump? I would like to see the carbon producers pay directly for their polluting products rather than just increasing the gasoline sales tax.

6. Finally, I wish Ms. Ebehard could assure me that the taxes collected, if the CarbonWa proposal becomes law, will be sufficient to cover the resulting lower sales and B&O tax collections. This did not happen in British Columbia, resulting in a serious revenue shortfall.

Yoram Bauman

Some responses to Ron Hawk’s questions:

1) [Revenue-neutrality of the Working Families Rebate]

The Working Families Rebate is similar to (and based on) the federal Earned Income Tax Credit, which has gotten bipartisan support in Washington DC. (There was a major expansion under President Reagan, who said it was “the best anti-poverty, the best pro-family, the best job creation measure to come out of Congress”. And there was a major expansion in 1993, under President Clinton, who said “we will reward the work of millions of working poor Americans by realizing the principle that if you work 40 hours a week and you’ve got a child in the house, you will no longer be in poverty.”)

As for your technical question of whether it is revenue neutral, the state Department of Revenue says: “This law created a sales tax exemption in the form of a refund for low-income families, using the federal Earned Income Tax Credit (EITC) as a proxy for sales tax paid… The program was initially considered a credit, but later determined to be an exemption.” So it’s officially a tax exemption, hence revenue neutral.

2) [Does the Working Families Rebate need an annual renewal?]

Under the Carbon Washington proposal, funding for the Working Families Rebate would be automatic. See section 15(4) of the ballot language; it removes the language about needing an annual appropriation.

3) [Who benefits from B&O tax reduction?]

The B&O tax reduction is about 15% of the policy. You can see who currently pays B&O manufacturing tax via this Department of Revenue dataset.

4) [Sales tax savings for an average family]

See the details in the methodology document for the tax swap calculator, but basically our approach is based on Department of Revenue data. Here’s an example as quoted in the methodology document: “If your household income is $55,000 then you pay an estimated 3.7 percent of your income in [state and local] sales taxes, i.e., $2,035. So a one percentage point reduction would save you $2,035(1/8.95)=$227.” (Note that 8.95 is the average sales tax rate–state plus local–in Washington State.)

5) [Point of collection for carbon tax]

The carbon tax is collected “upstream”, e.g., the portion from gasoline is collected “at the rack” just like the existing gas tax. See details in Section 4 of our legal language.

6) [Revenue-neutrality]

See my previous post on this.

Linda

Does the carbon tax collected go back to the general fund, to infill the budget for the 1% sales tax reduction?

Kristin Eberhard

Yes. The net effect is that the state has the same budget, but it replaces some sales tax revenue with pollution tax revenue.