Something unprecedented happened in the United States this week: A nation moving at full economic steam slammed the brakes on its own locomotive, deliberately bringing its economy to a screaming halt.

The cause: Saving a million or more lives nationwide, particularly (but far from entirely) those of the medically vulnerable.

The cost: It’s not clear yet. But it will be steep. This week saw what seems to be the single biggest tsunami of layoffs in US history. Last weekend, an estimated 18 percent of US workers were already saying they’d been laid off or lost work hours, reflecting massive cutbacks and mandatory shutdowns in the restaurant, entertainment, travel, and events industries. On Tuesday, Oregon reported a 3,200 percent rise in unemployment claims, far beyond what it saw in the peak of the Great Recession; the latest figures for Washington are due soon. On Thursday, Goldman Sachs predicted 2.3 million new unemployment claims nationwide this week, a figure the Wall Street Journal reporter described as “apocalyptic.”

As Americans do their part to flatten the COVID-19 contagion curve, we need to protect the economically vulnerable. The best, fastest way to do that is with cash payments.

There’s a word for this situation—debt.

Every American who is or cares about someone medically vulnerable already owes a debt to the millions of workers who are now suffering. This recession is a burden dropped on millions of service-industry workers, many of them low-paid, by the public. If the public doesn’t do something to help them with that burden, many will be crushed by it.

Just as we can’t let a million people die without fighting to save them; we can’t let collateral damage from this catastrophe crush the economically vulnerable.

We’ve got to start mailing checks. And—this part is important—we’ve got to start doing it almost immediately.

The fastest way to help people is also the most flexible: cash

As the wave of layoffs cascades from industry to industry, it will leave human wreckage behind: among many other things, millions of missed rent and mortgage payments, which will, if they continue for too long, spread the crisis through the housing sector.

Various institutions are trying to throw up makeshift levees. Fannie Mae and Freddie Mac will give homeowners one-year extensions on mortgage payments. As various cities including Seattle and Portland declare “moratoriums” on coronavirus-related residential evictions, many landlords are surely negotiating similar deals with tenants.

As Brookings Institution housing analyst Jenny Schuetz pointed out last week, these sorts of measures are awkward kluges with hidden costs. It’s better to just give people cash.

Negotiated a reprieve with your landlord? Great, but now you have two months’ rent due soon and you still don’t have a paycheck. Already had enough saved to cover rent? Now is probably not the best time to let your health insurance lapse.

Cash works. Cash gives people the power to solve their unique problems. Housing advocates shouldn’t overthink this. This isn’t the only thing the US government should do, but it should give people cash, immediately, including to as many people as possible who will need it most.

How to get the cash payments out fast: Use a system we already have

Time is of the essence. Nearly 70 percent of Americans have less than $1,000 socked away for a rainy day; 30 percent of Americans—nearly 100 million people—have no savings at all. Most of the millions of people recently laid off, or facing dramatically cut hours, will burn through their savings in days. Getting them money now matters.

The saving grace may be that we already have several systems already in place that could push out cash payments fast.

The first is the Internal Revenue Service. In 2008, during the Great Recession, the federal government mailed checks to every person who filed a 2007 tax return and had a qualifying income of more than $3,000. Individuals with incomes greater than $75,000, or couples filing jointly with incomes greater than $150,000, received slightly less.

In 2019, almost 90 percent of US filers submitted their tax forms online. Perhaps as soon as April, the federal government could send checks via direct deposit to most of these 140 million households, circumventing the need for an application, verification period, or printing. The government could mail checks to the other 17 million filers who did their taxes on paper.

Of course, using tax returns isn’t perfect. Filing taxes is laborious, especially if you have multiple income sources, and many people never do. Individuals who didn’t make the minimum taxable income threshold last year, to require filing, also won’t have a 2019 tax record, so this misses people who are new to the labor force and those who finally made it back in thanks to what was, until this month, the tightest job market in 50 years.

There’s also the issue that rich households don’t need instant cash. But as law professor Daniel Hemel pointed out Thursday, that’s not a problem. We can just require anyone with high incomes this year to pay the country back on next April’s tax return.

Boosting unemployment insurance could pay out faster, target people laid off, and keep workers ready to leap back into jobs

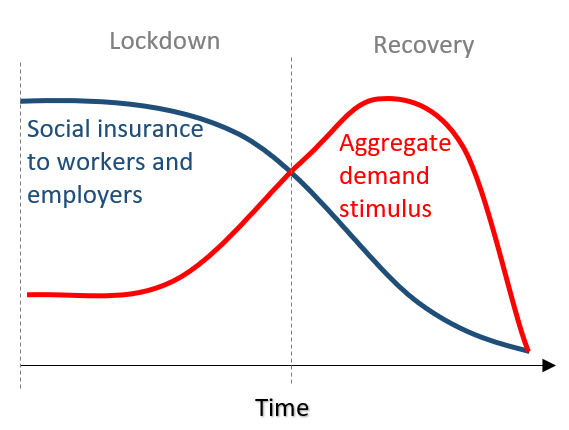

Enhanced unemployment insurance could work in tandem with stimulus checks to soften the blow of recession and accelerate recovery. Chart: Arin Dube.

State-managed unemployment insurance (UI) programs could also be used to funnel federal dollars to anyone facing lost income due to the pandemic. States could reduce their eligibility requirements—slashing the application waiting period, waiving the requirement to look for work, and reducing past earnings requirements—and increase the replacement rate, so anyone receiving benefits retains most, if not all, of their income.

Though some state UI websites are crashing due to unprecedented application rates, it’s possible UI systems are positioned to provide immediate relief to those already bearing the brunt of coronavirus lockdown. This relief could help cover the gap while DC puts together a more comprehensive aid package to help households weather the coming months.

As spelled out this week by the Seattle-raised labor economist Arindrajit Dube, a UI approach could put cash in people’s hands by the beginning of April, cost something like $160 billion over six months, target many of the people and locations most in need, and preserve crucial links between workers and employers, preparing the economy to bounce back faster once lockdowns end.

There are also big cracks in the UI system, though. It leaves out everyone not on a traditional payroll, including self-employed workers and contractors. That’s one reason we should use it in combination with universal payments, as Dube argues.

Something to depend on: coronavirus cash payments

It’s not clear how long this economic storm will last. The variety of direct-payment plans currently churning through Congress take various approaches to the possible need for checks to keep coming. The fact is that it’d take a durable program, with regular and reliable payments, to help economically vulnerable people weather this storm for as long as it takes.

Because cash is so endlessly flexible, there isn’t much debate among economists about the theory that, generally speaking, it’s the best way to help people. Instead, the big argument against cash payments has been that it’s politically impossible. Cash payments are best at helping people in need, but supposedly make voters uneasy.

But for better or worse, this is a new world.

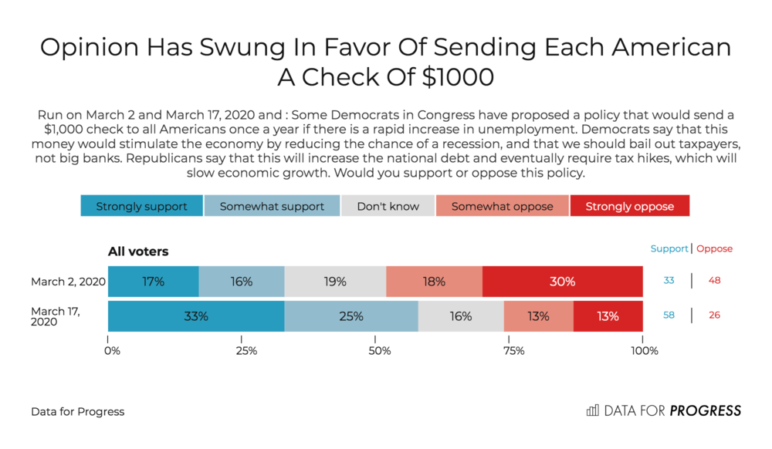

The day after Utah Republican Mitt Romney came out for universal $1,000 cash payments as part of an anti-recession package, left-aligned polling firm Data for Progress repeated a question they’d put to Americans just two weeks earlier and came up with a radically different answer:

Cash is fast. It’s flexible. It’s predictable. It’s easy to understand. And now it’s a solution gaining mainstream attention and popularity—across party lines.

We opened this piece by arguing that we now owe a debt to the workers on the front lines of our economy. The best way to pay that debt is with money: coronavirus cash payments.

This is true whether or not you agree with the final point we’ll make today: After this crisis ends, the checks should keep coming.

The government should start sending regular cash payments to everyone. This will be the subject of our next post.

Tom

Will see

Adam

We will all end up paying for this free money in the form of dollar devaluation and inflation. A few years from now, a dollar might only be worth half or less what it is worth now. Everything could end up costing twice as much or more. You will need an income twice what you make now just to maintain your existing standard of living. But we’ll see what happens.